Access to Markets - Malawi

- Malawi

- Resources

- Market Information

- Access to Markets

Market information: export and local markets in Malawi

Malawi provides various opportunities in agriculture, including livestock production (for dairy and beef), aquaculture, horticulture, ago-processing, sugar, piggery, bee farming, integrated cotton development, cassava production, and mushroom growing. These agriculture products can be processed and exported under trading arrangements encompassing SADC, COMESA, and Generalized System of Preference (GSP) Scheme of the EU’s EBA Initiative. The African Growth and Opportunity Act (AGOA), China General Tariff Preferential Treatment, the India Preferential Trade Arrangement Benefiting LCD’s and the Japan Preferential Trade Arrangement Benefiting Least Developed Countries (LDCs).

Specific Investment Opportunities:

• Cold room and relevant transportation infrastructure

• Processing factories for value addition to make puree, spices, pastes and juices.

• Storage, cleaning and grading facilities

• Large-scale commercial farming

• Market development

• Contract farming

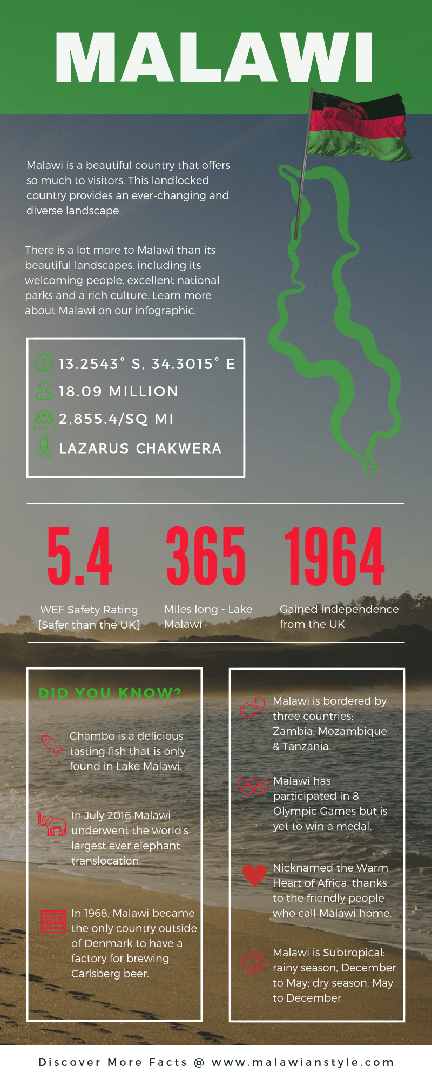

Other investment opportunities include Mining, Tourism, Infrastructure, manufacturing, energy, Information and communication technology, forestry and water sanitation. The country is blessed with vast natural resources and it enjoys a tract of beautiful natural scenery including game reserves and sandy beaches along the beautiful Lake Malawi. Lake Malawi is one of the largest freshwater bodies in the world and holds the most diverse number of fish species in one single body - over 800 species. Democratic principles are firmly en-grained in the country; since its independence in 1964, the country has never suffered a civil war and its political leaders have come to power through a democratic electoral process.Free-market principles are also firmly adhered to and successive Governments have continued to open and liberalize Malawi’s economy.

Trade policy and market access

Malawi has a plentiful base of natural resources that remain relatively unexploited, especially with regards to minerals which have the potential to transform the economy going forward (African Development Bank 2013 & 2012).

Global Enabling Trade Report World economic forum 2014

|

Trade Agreements

Malawi continues to participate actively in bilateral, regional and multilateral trade agreements with a view of benefiting from a wider market access and integrating into the global economy. Malawi is relatively open to international trade and investment, and imposes no restrictions on foreign ownership, size of investment, source of funds, or the destination of the final product.

The average Most Favoured Nation (MFN) applied tariff in 2012 was 12.7 per cent with agricultural imports facing higher average rate (18 per cent) and non-agricultural imports facing slightly lower average rate (12 per cent). The country is a member of the WTO. Malawi also has asymmetrical bilateral trade arrangement with South Africa and symmetrical bilateral trade agreements with Zimbabwe and Mozambique, which facilitate the duty-free quota free export of Malawi products to these markets.

Malawi is also a beneficiary of the African Growth and Opportunity Act (AGOA), a U.S. trade preference program. As part of its trade policy, the country has been gradually reducing protections granted to domestic trade by shifting its sources of revenue from customs duties to consumption and direct taxes. Malawi is also a member of the regional trade agreements including the Common Market for Eastern and Southern Africa (COMESA) and Southern African Development Community (SADC).

It has aligned its common external tariffs with COMESA requirements and generally applies no customs duties to imports from COMESA countries. The country has other preferential trade arrangements in place such as African Growth and Opportunity Act which allows Malawian textiles and apparel for duty and quota free market access to the United States, and Everything-But-Arms Initiative which is especially beneficial to Malawian exports of tobacco, followed by sugar and tea, duty and quota free into the EU.

The most recent exports are led by raw tobacco (53% of export value), tea, sugar, cotton, coffee, rubber, macadamia nuts, soya, nuts rice, spices, textiles, gemstones and from 2009 /10, uranium. The main export destinations of Malawi in 2017 were Belgium, South Africa, Tanzania, Germany, and Egypt. Imports are led by refined petroleum which represents 9.2% of total imports. The top import origins were South Africa, China, and India (World Trade Organization).

Malawi's main imports are food, petroleum products, building materials, fertilizers and transport equipment. Exports are incredibly important to modern economies because they offer people and firms many more markets for their goods. One of the core functions of diplomacy and foreign policy between governments is to foster economic trade, encouraging exports and imports for the benefit of all trading parties. However, the covid-19 crisis has left devastating impact in the Sub-Saharan region. The recession in the region will be mainly driven by Nigeria and South Africa, the two biggest economies in the region, which is poised to record a negative growth of 1.6 percent, the worst reading on record.

On the local market front, Malawi has two commodity exchange that provide market access, and these includes, Auction Holdings Commodity Exchange (AHCX) and Agricultural Commodity Exchange (ACE). There are also big outlet markets such as Shoprite, Chipiku that provide market access for domestic farmers who produce vegetables, rice, honey and chillies amongst others. The Malawi Investment Trade Centre (MITC) has created a Telegram that provide market linkages for local farmers, build capacity and coaching seminars. They also have business clinics like in the honey sector where they invite experts to teach farmers about packaging requirements, trade facilitation, product development and hand holding for would be exporters.

Why invest in Malawi

- Democratic dispensation with rule of law as a governing principle

- Peaceful country with no history of conflicts nor any prospects on the same

- No restrictions on foreign ownership of businesses

- No restriction on the repatriation of profits or capital gains

- Improving business environment

- Commitment to private sector investment through legal and regulatory reforms;

- Tax rebates for big investors

- Existence of Export Processing zones with tax incentives

- Duty waivers for health sector investments

- Preferential trade agreements with the United States through the AGOA Act, the European Union (Everything But Arms)

- Bilateral Trade Agreement with a number of countries;

- Regional market access through COMESA, SADC and the upcoming the Grand Free Trade Area involving the two regional blocs

- Good and improving telecommunications infrastructure