Accès aux marchés - Égypte

- Égypte

- Ressources

- Informations Sur Le Manché

- Accès aux marchés

Egypte : un marché de consommation attractif pour les investisseurs

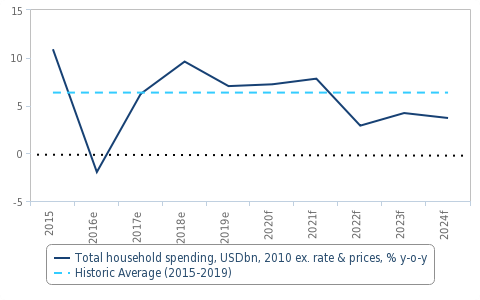

Croissance des dépenses réelles des ménages en Égypte

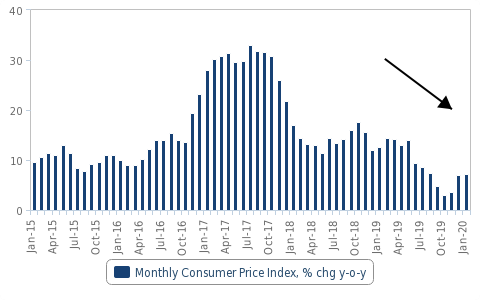

- Les attentes de croissance des dépenses des ménages en Égypte sont soutenues par la stabilisation des niveaux d'inflation, notre équipe chargée du risque pays prévoyant que l'inflation globale atteindra 6,8 % en 2020, contre 9,4 % en 2019 et bien en deçà du taux de 2017, lorsque la moyenne était L'inflation des prix à la consommation est 29,6 %. En janvier 2020, l'indice mensuel des prix à la consommation (IPC) a augmenté de 7,2 %, ce qui est bien inférieur aux 12,7 % de janvier 2019.

- La croissance des dépenses des ménages sera encore stimulée par la conclusion du programme égyptien de réformes structurelles 2016-2019 dirigé par le FMI, qui a incité le gouvernement à augmenter les prix, par exemple, du gaz et du pétrole, ainsi que de l'électricité et des denrées alimentaires de base, notamment le pain et le lait. En outre, le salaire minimum et les pensions ont été considérablement relevés en mars 2019, le salaire minimum du secteur public étant désormais fixé à 2 000 EGP par mois, soit 66 % de plus que le taux précédent. Nous nous attendons à ce que ces gains salariaux continuent de se répercuter au début de 2020. Nous nous attendons également à ce que les résultats des grandes manifestations contre la corruption gouvernementale fin septembre 2019 conduisent le gouvernement à assouplir son assainissement budgétaire tout au long de 2020, ce qui sera une aubaine pour la croissance de la consommation.

Taux de croissance des dépenses réelles des ménages en Égypte (2015-2024)

L'effet de l'inflation sur la croissance des dépenses des ménages en Égypte

À moyen terme (2021-2024), les dépenses réelles des ménages devraient continuer d'augmenter, mais sur une trajectoire plus lente, à un rythme moyen de 4,7 % par an. Il s'agit d'un niveau normal après la reprise de l'Égypte depuis 2016. Nous pensons que la poursuite des attentes de croissance des dépenses de consommation, ainsi que les fondamentaux notables de la consommation ci-dessous en Égypte, conduiront à une augmentation des investissements dans le secteur de la vente au détail du pays.

IPC mensuel en Égypte (2015-2020)

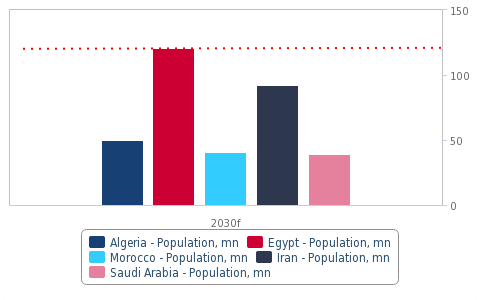

Données sur l'augmentation de la demande sur le marché local en Égypte

- Population : L' Égypte possède la plus grande population de la région Moyen-Orient et Afrique du Nord (MENA), avec environ 102,3 millions de personnes en 2020, offrant une large base de consommateurs pour les détaillants. À titre de comparaison, les populations d'autres pays du Grand Moyen-Orient tels que l'Iran, l'Algérie et l'Arabie saoudite sont respectivement de 84 millions, 43,9 millions et 34,8 millions. Au cours des dix prochaines années, la population totale de l'Égypte augmentera à un taux de croissance annuel composé de 1,9 %, pour atteindre 120,8 millions d'ici 2030.

- Jeunesse : Le groupe démographique le plus important en Égypte est celui des jeunes (20 à 39 ans), qui représentent près d'un tiers de la population du pays. En 2020, nous estimons que les jeunes représenteront 31 % de la population totale. Les détaillants considèrent ce groupe d'âge comme un groupe cible car ils ont un pouvoir d'achat relativement élevé et sont plus disposés à acheter des biens de consommation nouveaux et innovants, par rapport aux générations plus âgées.

- Classe moyenne montante : en 2020, nous prévoyons que la majorité de la population égyptienne vivra dans des ménages à faible revenu, avec 66,4 % des ménages résidant dans la tranche de revenu disponible de 1 000 à 5 000 $ par an. Cependant, au cours des cinq prochaines années, nous nous attendons à un mouvement à la hausse encore plus important, les consommateurs passant de cette tranche de revenu disponible à la tranche de revenu disponible de 5 000 à 5 000 $, qui, selon nous, passera de 28,4 % du total des ménages en 2020 à 48,1 %. en 2024. En 2024, 11,7 % des ménages du pays auront un revenu disponible de plus de 10 000 USD, soit une augmentation par rapport à 4,3 % en 2020.

L'Égypte est en tête de la région du Moyen-Orient et de l'Afrique du Nord en termes de population

En raison des attentes de croissance des dépenses de consommation en Égypte, ainsi que des fondamentaux de la consommation du pays, les institutions financières prévoient d'augmenter les investissements dans le secteur de la vente au détail du pays (en particulier dans les secteurs des épiceries et des centres commerciaux).

Certaines preuves de cela émergent déjà.

- La chaîne de supermarchés des Émirats arabes unis Lulu Group a annoncé en août 2019 qu'elle cherchait à investir 500 millions de dollars en Égypte à court terme pour créer six hypermarchés et quatre magasins de proximité afin d'accroître sa présence dans le pays. Tous les nouveaux magasins seront basés au Caire, y compris Obour, New Cairo et 6th of October City.

- Carrefour by Majid Al Futtaim prévoit d'ouvrir trois nouveaux hypermarchés et 24 supermarchés en Égypte en 2020. Par ailleurs,

- Al-Futtaim, basée à Dubaï, a annoncé en décembre 2019 qu'elle investissait deux milliards de livres égyptiennes (127,8 millions de dollars) dans l'extension de 22 140 mètres carrés de l'extension du Cairo Festival City Mall. Il comprendra 80 détaillants, 15 points de vente d'aliments et de boissons et la première aire de restauration internationale en Égypte.

Perspectives démographiques pour les pays du Moyen-Orient et d'Afrique du Nord - (2030)

Alors que la population jeune et croissante de l'Égypte, une classe moyenne en plein essor et la stabilisation de l'inflation sont de bon augure pour les détaillants du pays, nous soulignons que certains obstacles pourraient affecter ces perspectives. Les entreprises continuent de se heurter à certains obstacles juridiques et bureaucratiques à leurs activités en Égypte. Ce que le gouvernement égyptien cherche à changer à travers la nouvelle loi sur l'investissement et l'application de l'e-gouvernement